Resources > Article > The IoT Market: Ready for Transformation and Growth—Where Investors Can Create Value

The IoT Market: Ready for Transformation and Growth—Where Investors Can Create Value

In this article, Gareth Williams and Iqbal Singh Bedi explore why the current state of IoT fragmentation creates a window of opportunity for consolidation—and how investors can identify and position acquisition targets to build the next wave of full-stack, scalable IoT platforms.

Over the past two decades, the Internet of Things (IoT) has matured from concept to core infrastructure. Its applications now span sectors—from fleet tracking and energy management to smart manufacturing and social housing—and many solutions have evolved from simple device connectivity to full-stack offerings that integrate software, platforms, analytics, and AI.

As this market matures, so too does investor interest. Private equity-backed firms such as Wireless Logic (Montagu), AddSecure (Castik Capital), CSL (ECI Partners), North (Livingbridge), and Connexin (PATRIZIA/Whitehelm) have already demonstrated how strategic acquisition can drive scale, capability expansion, and geographic reach. Others, like Netmore, are deploying capital to build presence in specific verticals—such as LoRaWAN infrastructure and smart city solutions—highlighting the diversity of strategies emerging in response to ongoing fragmentation and technological evolution.

Yet despite this progress, the market remains highly fragmented—populated by under-scale operators, vertically niche players, and capability-constrained providers. At the same time, IoT’s next phase will be shaped by more complex customer demands, regulatory scrutiny, and emerging technologies like edge-based AI and resilient connectivity.

This article explores why the current state of fragmentation creates a window of opportunity for consolidation—and how investors can identify and position acquisition targets to build the next wave of full-stack, scalable IoT platforms.

Market Maturity and Fragmentation

The term “IoT” may have been coined in 1999, but the market has truly come of age in the past decade. Adoption has accelerated across sectors, delivering tangible value in use cases ranging from predictive maintenance and fleet logistics to smart cities and public infrastructure.

Many firms offering IoT solutions have evolved from basic device onboarding and connectivity into integrated providers of analytics, platforms, and managed services. These players span MNOs, MVNOs, system integrators, and vertical SaaS providers.

However, the landscape remains structurally fragmented. Many firms are:

Under-scale, lacking geographic reach or commercial weight

Vertically focused, serving narrow sectors like utilities or housing

Capability-limited, addressing only a portion of the value chain

This fragmentation is being tested by the rising expectations of enterprise and public sector customers who now require integrated, secure, and scalable solutions.

Emerging Technology and Regulation: What Separates Future Platforms

The next phase of IoT growth won’t just be driven by more devices—it will be shaped by how well solution providers integrate emerging technologies and meet rising regulatory demands.

AI is already transforming the IoT value chain. Edge-based AI reduces latency and cloud dependency, improving responsiveness and bandwidth efficiency—especially in mission-critical or high-data environments. Agentic AI, capable of acting autonomously using orchestration tools and APIs, is beginning to reshape how use cases like predictive maintenance or energy optimisation are delivered. These aren’t futuristic features—they’re fast becoming differentiators that define which firms will lead in the AIoT era.

At the same time, security and compliance are no longer optional. From the UK’s PSTI Act to the EU’s NIS2 Directive and Cyber Resilience Act, IoT providers are being held to higher standards. Requirements now include device-level security, incident reporting protocols, data sovereignty controls, and—in some cases—resilient multi-core connectivity. For example, resilient SIMs (rSIMs) can ensure uptime by switching between mobile cores if one fails—crucial for critical infrastructure like energy networks or healthcare.

For investors, these two forces—technological advancement and regulatory complexity—are more than background trends. They are filters. The most attractive targets will not only demonstrate growth potential, but also platform resilience, regulatory readiness, and future-facing capability.

Investor Opportunity: Consolidate, Diversify, and Integrate

IoT market players now face rising pressure to integrate emerging technologies, navigate regulatory complexity, and meet more demanding customer needs. These shifts open new growth and investment opportunities for those who can consolidate capability and scale into full-stack platforms.

The IoT market is about to transition to a new growth phase, in which investors can choose to consolidate, professionalise, and scale the next wave of integrated IoT platforms. Success depends on gaining an in-depth understanding of targets and how best they can evolve to satisfy market needs.

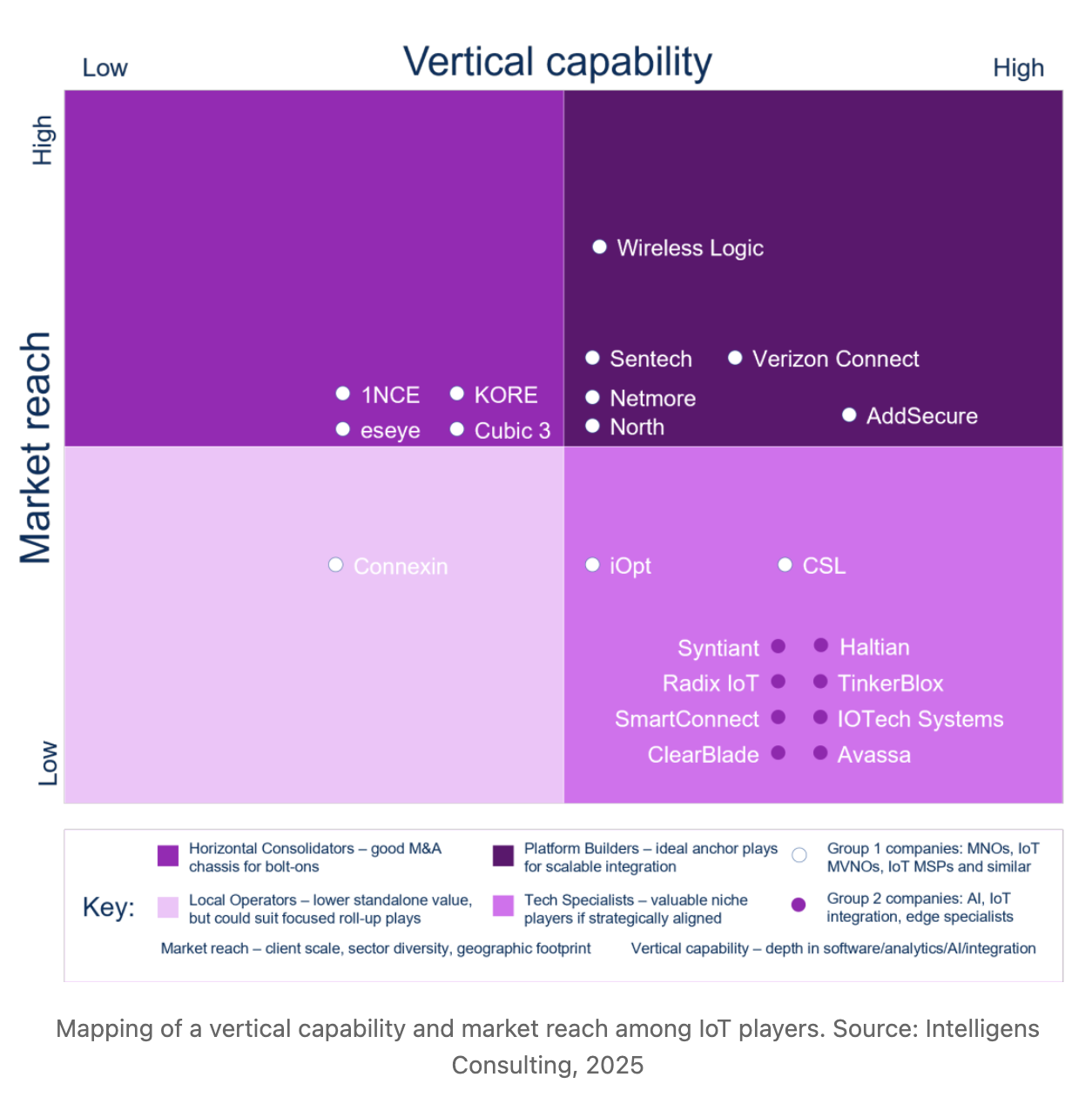

Each potential target differs in terms of vertical capability and market reach. Figure 1 maps a selection of IoT market players—from MNOs and MVNOs to software, AI, and edge analytics providers—according to these two key dimensions.

The upper-right quadrant—high capability and high reach—represents the most valuable ground, where future platforms will emerge by unifying disparate systems and applying AI at the edge to deliver actionable, real-time intelligence.

Strategic Implications of Group 1 and Group 2

Within Group 1 companies—such as IoT MVNOs, MNOs, and managed service providers—further consolidation is likely to increase scale, geographic reach, and sector diversity. These firms may acquire other Group 1 players to strengthen core infrastructure and distribution.

However, the more transformative opportunity lies in bridging capabilities between Group 1 and Group 2. Group 2 companies—typically AI, software, or edge computing specialists—offer valuable enhancements to unlock deeper integration, better data orchestration, and AI-driven responsiveness. Examples include Avassa, ClearBlade, IOTech Systems, and Radix IoT.

While some Group 1 firms may attempt to build these capabilities organically, acquisition or partnership is likely the faster, more viable route, particularly when speed to market and technical depth are critical.

Closing Thought: Timing the Transition

Upper-right quadrant companies with both deep capability and broad market reach is where the next wave of value creation lies. These are the players best positioned to lead as expectations grow around integration, regulation, and AI-readiness.

The question for investors is not simply who is growing, but who is ready to scale, integrate, and lead in the platform-driven era of IoT.

Can Radix IoT Help Your Operations? Let's Find out!

Leveraged by telecom, energy, datacenters and facilities’ operations worldwide – the Radix IoT platform seamlessly unifies data across pre-existing assets and systems. As a result, our customers get the real-time data insights needed to more effectively manage their operations and better protect their bottom line. We invite you to learn more – request a demo today!